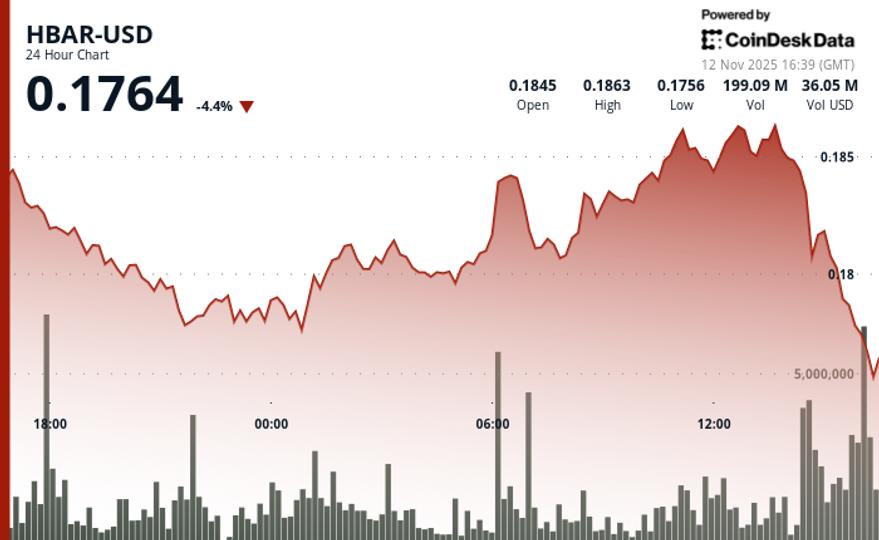

HBAR slipped 0.6% to $0.1849 in Tuesday’s volatile session, testing the lower boundary of its recent trading range.

The decline from $0.1860 unfolded across a $0.0090 range, generating nearly 5% intraday volatility as traders probed key support and resistance levels.

Trading activity spiked, with volume hitting 85.9 million tokens—47% above the session average—reflecting intensified selling near the $0.1860 resistance zone.

The token initially found support at $0.1775 before rebounding to $0.1865 by mid-session. However, renewed selling pressure emerged in the final hour, pushing prices below crucial support and cementing a short-term bearish tone heading into Wednesday.

Still, the bearish technical outlook contrasts with Hedera’s strong enterprise positioning. Partnerships with Google Cloud, IBM, and Boeing continue to highlight its institutional relevance in the blockchain sector.

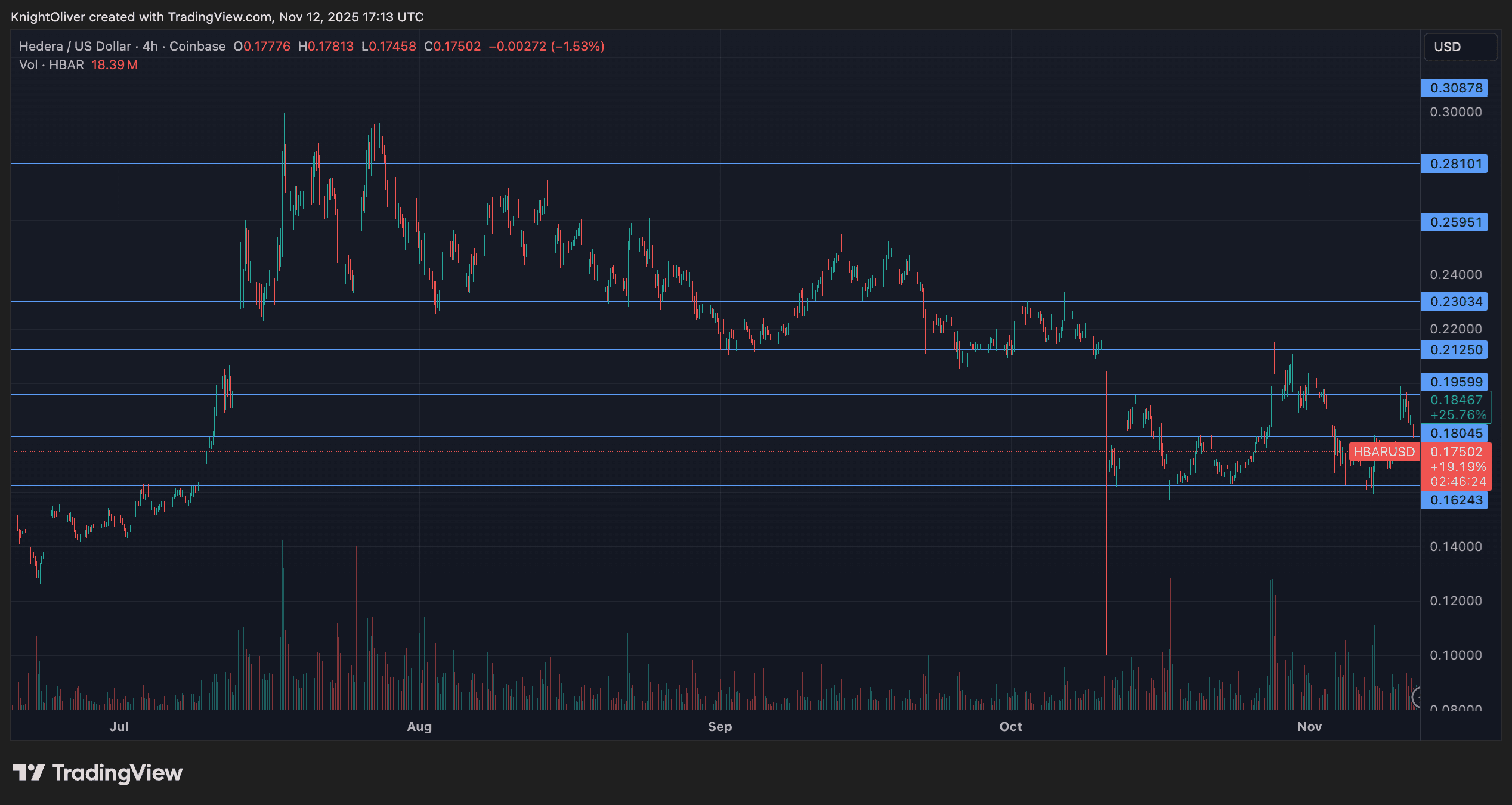

Key Technical Levels Signal Range Breakdown for HBAR

- Support/Resistance: Primary support shifts to $0.1840-0.1845 zone following breakdown, while resistance holds at $0.1860-0.1865 range highs from Tuesday’s session.

- Volume Analysis: 85.9M token volume spike at resistance confirmed selling interest, though activity normalized during final hour decline to below-average levels.

- Chart Patterns: Range-bound structure between $0.1775-0.1865 invalidated on downside break, establishing new lower consolidation framework around current levels.

- Targets & Risk/Reward: Immediate downside target at $0.1840-0.1845 represents 0.3-0.5% decline from current levels, while reclaim of $0.1860 triggers retest of $0.1865 range highs.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.