Bitcoin BTC$100,729.38 and the rest of the crypto market continued the trend of not just losing ground, but notably sliding the most during U.S. market hours.

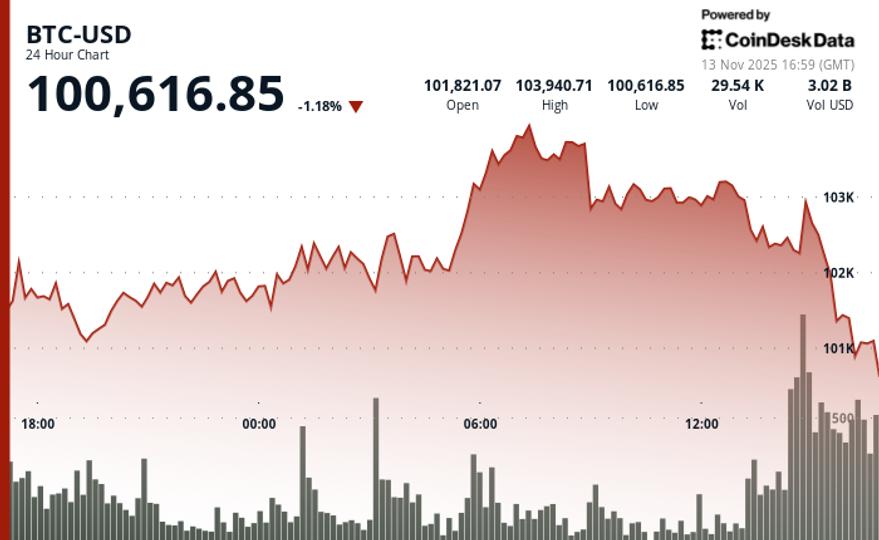

Following a recent pattern, BTC had bounced to as high as $104,000 overnight but reversed course in early U.S. hours, barely holding above $100,000 just past the noon hour on the east coast and now lower by more than 1% over the past 24 hours.

The retreat came amid a steep broad decline in risk assets as investors come to grips with the idea that the Fed — at the moment — doesn’t appear intent on cutting rates in December. The Nasdaq is down 2% and S&P 500 1.3%.

Crypto-linked equities were hit hard once more, especially miners with heavy AI infrastructure and data center exposure. Bitdeer (BTDR) plunged 19% and Bitfarms (BITF) dropped 13%, while Cipher Mining (CIFR) and IREN lost over 10%. The rest of the crypto equity sector also saw steep losses: Galaxy (GLXY), Bullish (BLSH), Gemini (GEMI) and Robinhood (HOOD) were all down 7%-8%.

BTC’s 2025 peak could be in

The pullback underscores a trend that’s defined crypto markets in recent weeks: persistent weakness during U.S. hours, coinciding with cooling expectations of a December rate cut from the Federal Reserve.

“Crypto is closely linked to macro-economics now more than anytime in the past,” said Paul Howard, senior director at trading firm Wincent.

With markets now pricing in roughly 50/50 odds for a 25 basis points rate cut next month, Howard expects BTC to stay muted near current levels for the remainder of the year.

“My sense is with just six weeks left, we’ve seen the all-time highs for 2025,” he said. “From here, we likely get a steady ascension over the course of the coming year — volatility acknowledged.”